The recently released Barclays Africa Group Financial Markets Index Report takes an in-depth look at the financial markets of 17 countries. These countries make up 60% of the continents GDP. The index was a quantitative and qualitative analysis and assessment of the anatomy of Africa’s financial markets. It was aimed at tracking progress and initiating conversations that will address the gaps in the markets to promote development. Is Africa Rising? Looking At How Africa’s Financial Markets Are Performing According To Barclays Financial Markets Index

In terms of overall performance, Kenya ranked 5th with a total of 59 points out of a possible 100 ahead of economic giants such as Nigeria, Ghana and Egypt due to ongoing reforms in the financial markets. The performance was linked to strong contract enforcement but over-cautious regulators. However, its financial markets emerged as the most sophisticated in the East African region and as one of the most advanced in the continent. The report used 6 pillars to analyze the data collected.

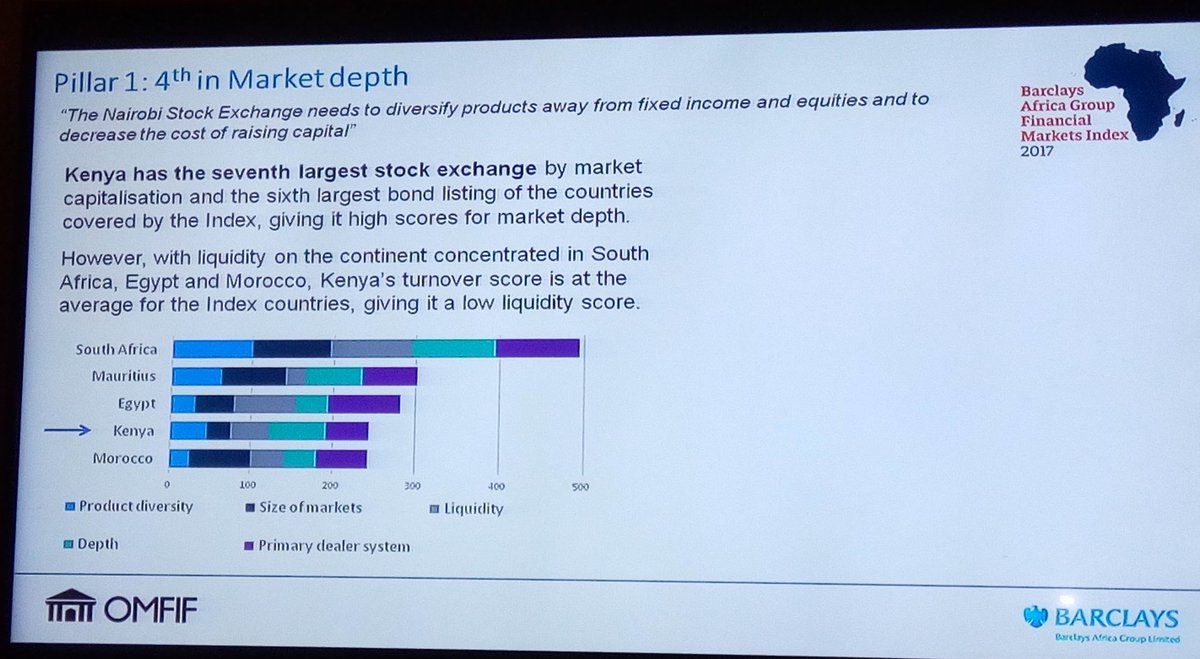

Pillar I: Market Depth

Challenges

Kenya ranked 4th in this pillar with a total of 49 points. Kenya has the 7th largest exchange stock exchange by markets capitalization and the sixth largest bond listing of the countries covered by the index giving it high scores for market depth. The issues faced by the country is this pillar are;

- Lack of strong market makers to take price risks

- Lack of strong dealership framework for a proper funding curve.

- Currency hedging.

The country’s turnover score is also at the average for the index countries giving it a low liquidity score. The poor performance is attributed to lack of market makers to augment brokerage to take price risks.

Access to finance by small and medium-sized companies is also a big issue seeing as they are the backbone of the economy. This can be attributed to high concentration of the banking sector causing high rate spreads. The high cost of loans then limits private sector’s access to funds.

Opportunities

There is need to increase small and medium-sized enterprises access to financial markets e.g. through dedicated market segments as a vital means of deepening markets. There needs to be an improvement of the regulatory and policy environment in order to attract foreign investment.

Kenya can get more market markers to broker deals and take price risks. This would require big investors with big pockets.

Diversifying of products away from fixed incomes and equities will reduce the cost of capital. This can be done by boosting markets share in export competition.

To boost liquidity, the NSE intends on short selling their stock. This plan is to be completed by the second quarter of the year. The NSE is also in talks with Africa Exchange on the linkage program that will see six stock exchanges merge in facilitating cross-border trade in stocks which include; NSE, Johannesburg Stock Exchange, Nigerian Stock Exchange, Casablanca Securities Exchange, Stock Exchange of Mauritius and Bourse Regionale des Valeurs Mobilleres.

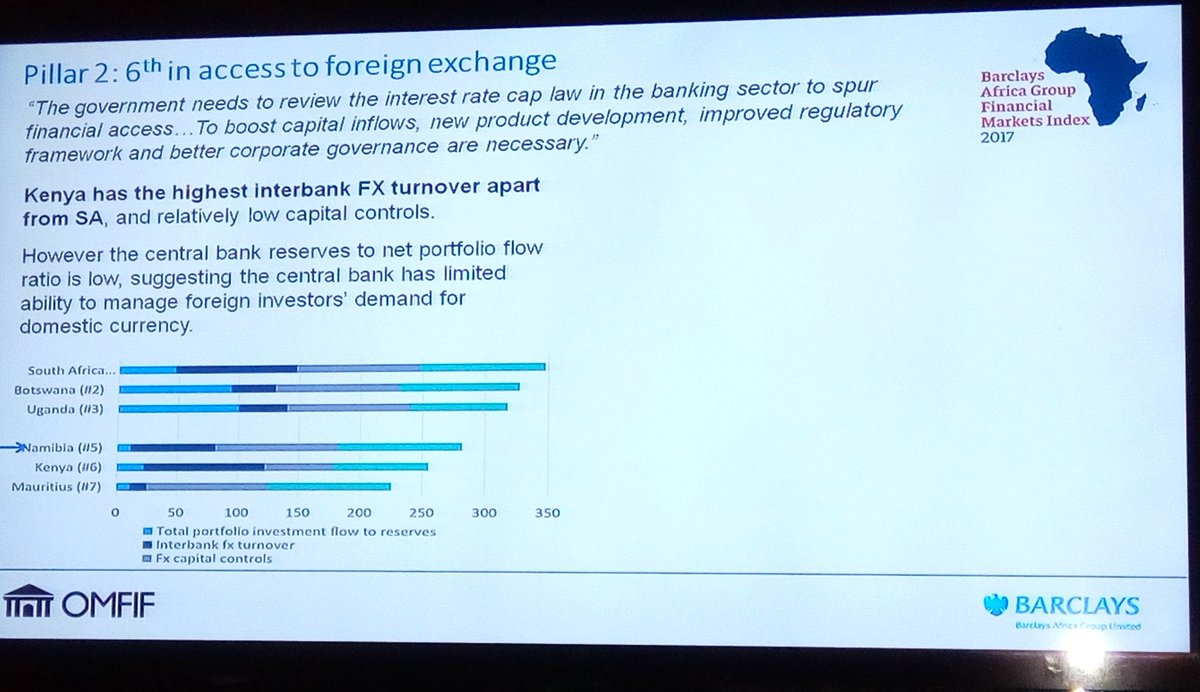

Pillar II: Access to Foreign Exchange

Kenya ranks 6th in this pillar with 64 points. The level of foreign exchange liquidity and easily accessible up to date foreign exchange data provide an important measure of financial resilience. Kenya has the highest interbank FX turnover apart from South Africa and low capital control. However, The Central Bank reserves net portfolio ratio is low suggesting that The Central Bank has limited ability to manage foreign investors demand for domestic currency.

Kenya’s high rate of portfolio investment compared with foreign reserves could be a source of financial instability in the event of large and sustained outflows which cause the exchange rate to depreciate and general financial conditions to tighten. However, it also indicates a high degree of openness which is crucial for development. This openness also comes with risks. It causes currency volatility which is a challenge for open economies.

Opportunities

To boost foreign exchange, there is need to broaden the market and bring in more participants by solving settlement risk and increasing credibility of the exchange rate.

The government needs to review the Interest Rate Capping Law in the Banking sector so that it may spur financial access, boost capital inflows and product development.

Local investors should also be encouraged to join the market. This way, they buffer the currency volatility when foreign investors leave the market.

Pillar III: Market Transparency, Tax and Regulatory Environment

Kenya ranked 7th in this pillar with 68 points. Robust financial market infrastructure is of vital importance for attracting foreign investors and incentivizing greater domestic investor competition. The tax environment should aim to encourage these investors through incentives and other fiscal measures.

Kenya’s Capital Markets Association (CMA) has helped market development but their impact has been limited by lack of involvement and coordination by all stakeholders concerned.

The country scores highly with compliance with international regulations but survey respondents raised questions about the capacity of auditors and regulators to fully implement agreements and standards.

In terms of the gap in tax laws, investors will prefer to go with infrastructure bonds as opposed to normal bonds because these do not accrue any local tax.

Opportunities

The country needs to have an increase in the involvement and participation of local investors and stakeholders to boost the impact of market development.

The increase of auditors and regulators to implement the standards set for financial market transactions can impact greatly on the country’s stand on the implementation of regulations.

The Capital Markets Authority has overseen the demutualization of the Nairobi Stock Exchange leading to the successful IPO and the development of the governance code of conduct.

Kenya should diversify treaties with double taxation bonds to reduce that tax gap. There is huge potential if there is structuring off of infrastructure bonds by offshore investments.

Pillar IV: Capacity of local investors

Challenges

Kenya was ranked 5th with a total of 31 points. Domestic institutional investors across African Markets particularly pension funds have become an important force in local economies. Though local investors have increased over the past decade local financial markets have often not kept the pace.

Opportunities

The country requires an increase in the number of local investors because they come to the rescue in the event foreign investors decide to pull out of potential investment opportunities in other countries.

The NSE also need to increase the number of companies in listed in order to provide investors with various options to boost investment.

Pillar V: Macro-Economic Opportunity

Challenges

GDP has generally gone down in the whole continent by 4.2% since 2013. In this pillar, Kenya ranked 6th with 69 points. Its performance was mainly marked by;

- Low GDP per capita

- Low historical growth in export market share

- Relatively small market capitalization

The low export share indicates reduced competitiveness and lower demand for exports in the external environment.

Opportunities

Even with low GDP, the country enjoys high regulatory bank capital ratios. This is an important consideration as countries with non-performing loan ratios may face elevated financial risks and vulnerability to external shocks.

Pillar VI: Legality and Enforceability of Standard Financial Markets Master Agreements

Challenges

Strengthening the legality of rules in financial markets can help attract investors by reducing counterparty risk. Kenya ranked 3rd with a solid 81 points in the last pillar.

We need to improve our insolvency framework and the use of Global Master Repurchase Agreement (GMRA), Global Master Securities Lending Agreement (GMSLA) and International Swaps and Derivatives Association (ISDA) master agreements.

Opportunities

There are laws that touch on how amenities are treated. The legal profession needs to align these laws and ensure that there is no confusion in cases such as insolvency.

There is need to improve on legal and regulatory certainty and ensure compliance with the contracts in order to promote the success of local financial markets.

Overall Kenya’s biggest opportunity in boosting their financial market position lies in market depth. Here we can take advantage of our existing infrastructure to diversify our markets. There is a lot that needs to be done and public-private partnerships will be important going forward to be able to enable Kenya to rank better in this year’s report.

Check out the Barclays Africa Financial Markets Index Report to see how other countries are performing.