The National Social Security Fund has played a pivotal role in ensuring all workers in the formal and informal sector have a secure future. You can access your retirements benefits from the age of 50 if you retire early or at 55 at the recognised time of retirement.

To be eligible for the benefits of the fund, members have to register and consistently contribute in order to enjoy the future benefits at hand. Here is why you need to save for retirement – Five Ways To Save For Your Retirement Without Straining Your Pocket

Here is how to register

On registering with NSSF, you are issued with a Membership Card. [Image Source/nssf.or.ke]

Registration to the National Social Security Fund is no daunting task to stress you out.

The NSSF membership is available to anyone aged 18 years and above. As long as you are involved in a meaningful enterprise within the country, you can register to start saving for a better and secure future.

One way of registration is to register as an employed member where your employer will deduct a set percentage of your salary to be forwarded to the NSSF. The amount deducted is a very small percentage of your salary.

Employees contributions range from 360 shillings to a maximum of 1080 shillings per month for the first year. Employers will also be contributing an equal amount as yours towards your future.

To register as a member, all you need to do is visit the nearest NSSF office near you. The offices are located in all major towns in the 47 counties.

You will need your original Identity Card or Passport. You will also need a letter from your employer.

Your information will be recorded and upon completion, you will be issued with an NSSF membership card. The NSSF number on the card will be required by your employer so that they can make direct contributions to your account. The other simple option is that you can make the contributions at any time using your Mpesa.

How To Register As A Self-Employed Member

NSSF membership is not only limited to those in employment. You can also register as a voluntary member. In this sense, you will be making your contributions at the nearest NSSF outlet or through your mobile service Mpesa.

To register as a voluntary member, you will need to visit the nearest NSSF office with your Identity Card or Passport or a copy of it. You will pay Ksh. 200 as an initial contribution to activate your card. Your details will be processed and you will be issued with an NSSF Membership card. You can then start making your contributions through Mpesa or at the nearest NSSF branch. You can contribute more if you wish.

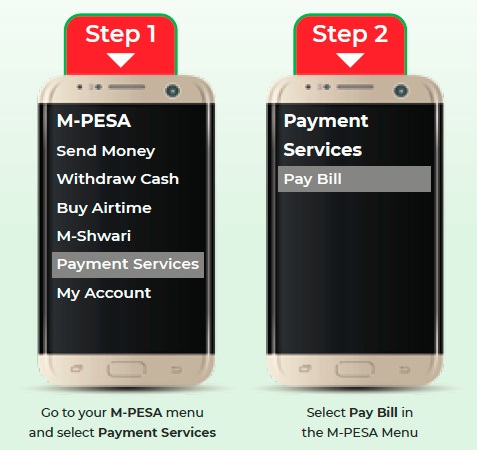

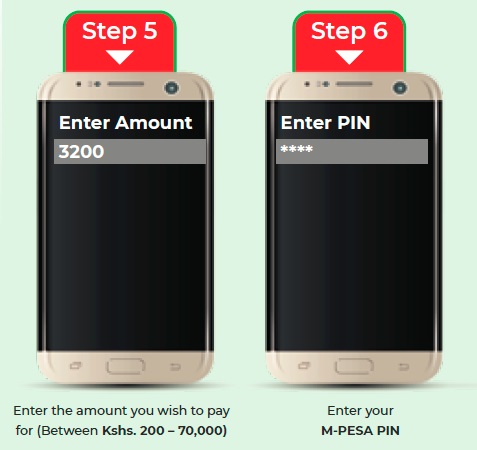

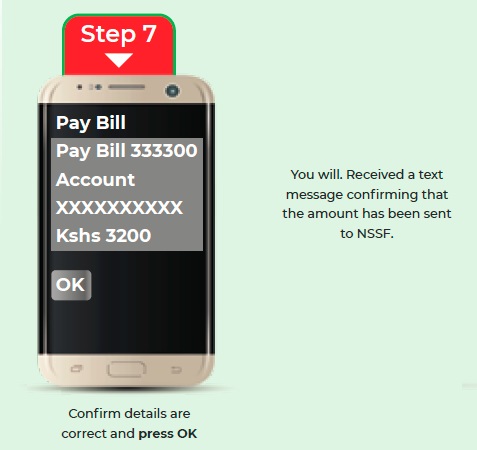

How to pay for NSSF via M-PESA.

You can pay your NSSF through Mpesa. Note that to do that as an NSSF Member you must be an M-PESA registered customer. You need to ensure that there is a sufficient amount in your M-PESA account to cover all the transaction charges

Registration for NSSF membership is also available online. You can click here to register online.

What is the importance of saving for retirement?

It is important to note that one should not only depend on NSSF for funds during retirement as the money contributed will not really give you the standard of life you are looking for based on employment. So you will also need to save for your retirement on your own, you can do this by joining a private retirement scheme or saving or investing money towards this. Why everyone needs a retirement benefits plan

Saving for retirement ensures that you live comfortably after retirement. The percentage of your salary injected into your savings account will be pivotal in giving you some kind of cushion in your retirement.

One of the biggest problems retirees have is that they overly rely on their children. A deep savings account will give you a cushion for this. You will be able to carry on with a decent lifestyle while also getting engaged in other meaningful enterprises while giving your children the chance to carry on and not worry so much about you.

Your life in retirement will also be happier and more comfortable. In this sense, you will not have to worry much about what you will have to do to sustain yourself after you leave your job. You can as well invest the savings in meaningful projects and the monies realized are directed towards your savings account.

With an individual retirement savings plan, you can move with the package from one employer to the next. You can also decide to stop the savings or reduce the amount of savings if your pocket does not allow you to make consistent savings. This gives you the opportunity to vary the amount of savings or make enormous contributions as you please.

Social Security is cannot be a viable sole source of income after retirement. In this sense, dedicating a percentage of your income to a retirement account will allow you that extra income that will be pivotal in making sure that your life stays on course after you retire.

Things you need to know about saving for retirement

Your saved money is subject to income tax when withdrawing. [image source/centralbank.go.ke]

After you retire and start withdrawing your retirement benefits, income tax will take effect. Depending on the amount of your contributions to your retirement account, you may end up in a higher tax bracket. Your saving gains will be subject to taxation and this means that you will pay tax on your savings.

The saved money is only available after you retire. In this sense, you will not be able to access the funds even in cases of emergencies. If you are contributing a big percentage of your salary to retirement savings, you will be helpless if an emergency befalls you immediately after you make the contribution.

Financial knowledge is important in planning and managing your savings. Here are a few useful tips on financial management.

Finances: Essential Retirement Moves To Make In Your 20’s And 30’s

You Can Now Access All NSSF Services At The Touch Of A Button On The M-PESA Super App