The MasterCard Global Destination index ranks cities in terms of the number of their total international visitor arrivals and the cross-border spending by these same visitors in the destination cities in 2016. This gives visitor and passenger growth forecasts for 2017. Public data is used in deriving the international overnight visitor arrivals and their cross-border spending in each of the 132 destination cities. This Index and the accompanying reports are not based on MasterCard volumes or transactional data.

In a bid to promote economic growth, most governments in Africa are continuously seeking ways to drive diversification as part of their growth strategies. Tourism is an important sector when it comes to promoting economic growth. This MasterCard index is important because provides insight into the motivations and travel spend of visitors. The Index ranks 132 global destination cities in terms of visitor spend and provides insight on the fastest growing destination cities, and a deeper understanding of why people travel and how they spend around the world.

Among the 132 cities, the index included 13 African cities which were; Cape Town, Durban, Cairo Lagos, Tunis, Nairobi, Maputo Casablanca, Accra, Dakar, Entebbe, and Beira. This was a show of an opportunity of African countries have to work together in order to promote the continents standing in the diversification of tourist services offered.

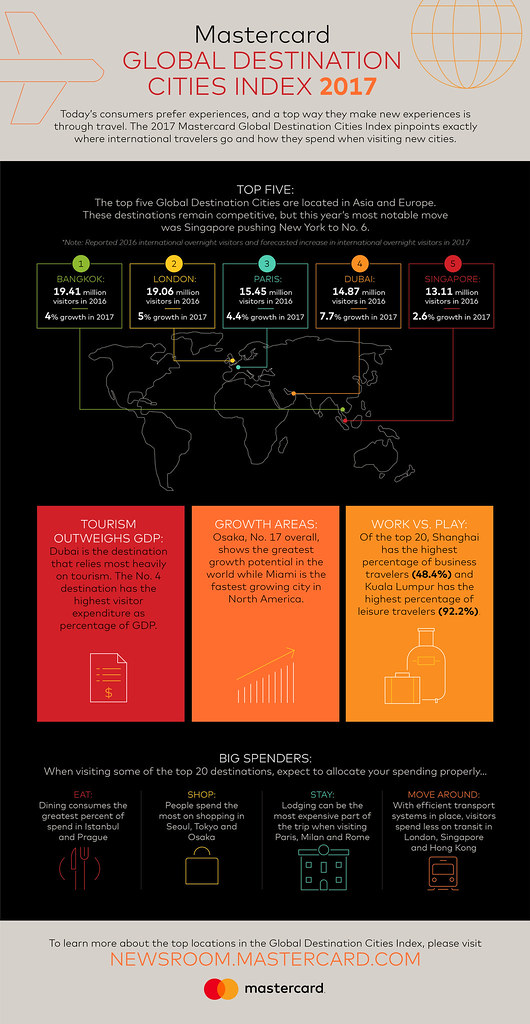

Some of the cities doing exemplary well according to the index were Bangkok, London and Dubai. Bangkok registered a 19.4 million overnight international visitor arrival with London hitting 19.03 million visitors in 2016 only. These two cities serve as great footprints for Africa for future planning by considering these two cities focus on mobility. With 4 million international overnight visitors, it is not surprising that Dubai ranks number one as having the highest percentage of visitor expenditure of GDP at 30.3%. Due to its global positioning as a hot shopping destination, Dubai has carved out a niche over most countries which it continues to thrive on.

So what can the African countries learn from the MasterCard Global Destination Index

The Index indicates expenditure categories that illustrate how people are spending when they visit these top performers. Among the top 20 ranked destinations, majority of the travel is for leisure purposes. Some key contributors include; dining, shopping, lodging and transport.

The index also indicates that more people than ever are visiting cities for business or leisure travel. The research further indicates that people expect their experience when travelling to be both seamless and personal. African countries must do more to connect potential tourists with what they have to offer.

Each city needs to identify its uniqueness and use it as a platform to market itself to the world. Most cities who know what they are about and what they have to offer attract more visitors. The problem is not the continent. It is widely known for its natural beauty, sights and sounds warm people and uniqueness which is rare in the world. These African countries just need to learn to harness all that potential and sell it to the rest of the world.

More than half of the top 20 destinations reported an increase in spend consistent with or greater than GDP growth. This is a show of the important role travel plays in an economy’s growth since it seems to grow faster than all other economic areas combined.

With this knowledge at hand, what can African Countries do to prepare for tomorrow?

Promote infrastructure and public transport– For highly attractive destination cities, like Bangkok, London and Paris that top the list, ease of travel is a big factor in drawing visitors. This is why MasterCard is working with governments and cities across Africa to simplify access to urban services like public transport. This will help to enable users to pay for their train or bus simply by tapping their card or swiping their phone.

Look deeper at the purpose of travel and spend– It’s safe to say that Africa is no longer just a safari destination, and the reason for travel to Africa varies largely by what a city has to offer. Using data to understand what appeals to travellers will give cities an upper hand to mine the popularity of that destination, and then further enhance the offering. Data is a smart way for tourism authorities to effectively and efficiently gather important insights. MasterCard’s Tourism Insight Platform provides data on spending as well as insights from search engines – proving that data is the tourism industries greatest asset and must be taken seriously.

Build stronger cross-sector partnerships– Expertise within the public sector must be harnessed, it is here where innovation is shaping African cities and helping to digitize economies. Tourism is a diverse offering, and governments are more willing than ever before to collaborate to realize the full potential of the sector. As indicated in the Global Destination Cities Index, cities must differentiate, provide unique experiences and ensure are capable of hosting people from around the world. This is achievable only via cross-sector collaboration, and a willingness to adapt.

To get more insights into how cities are doing in terms of tourism check out this article – Defining What Makes a City a Destination.

In Kenya Saffir Africa did some research on what travellers are looking for as they travel. Here is the report Travel In Kenya: Saffir Africa Report On Trends In 2017